The Most Valuable NBA Teams of 2024…

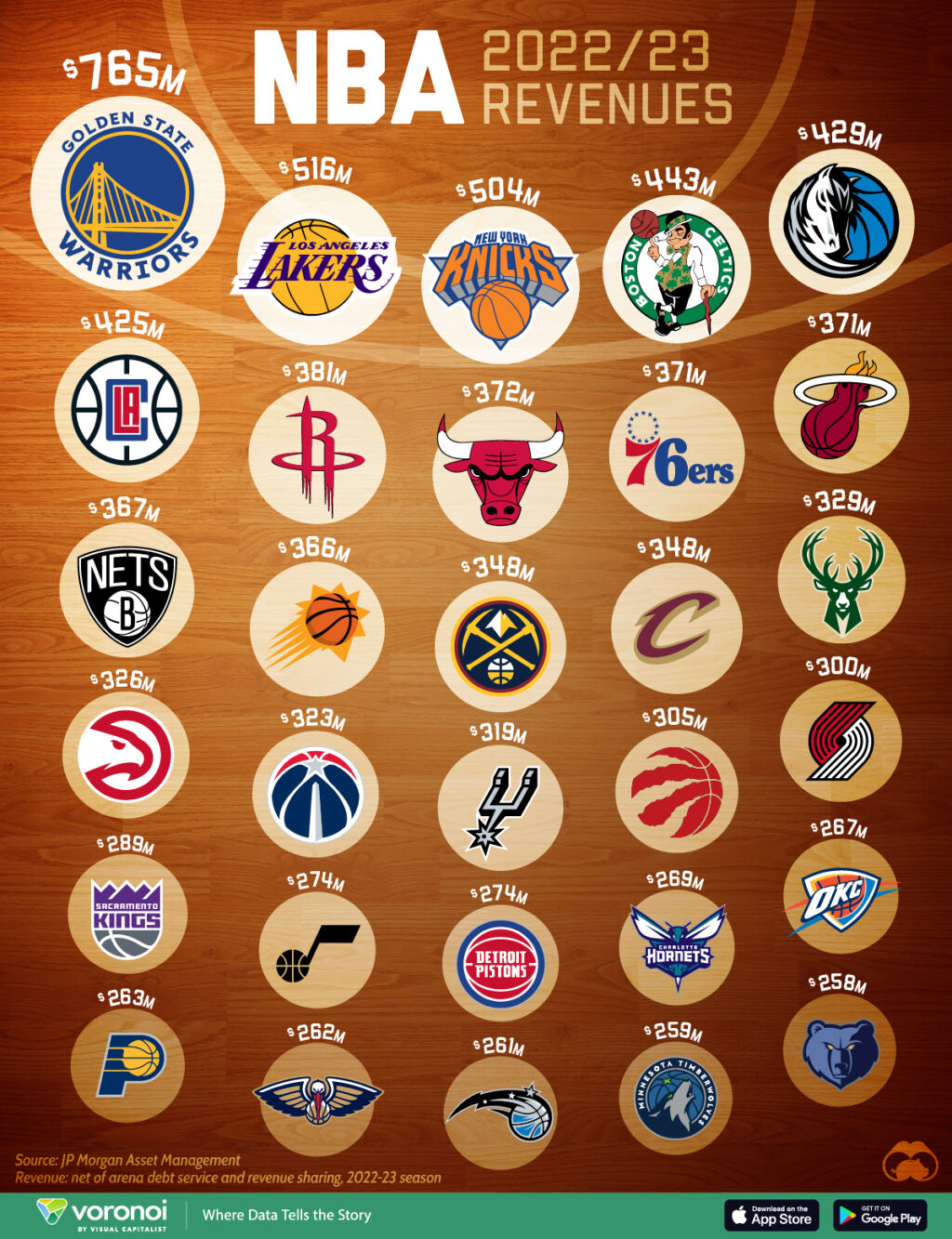

With record attendance and sponsorship for the 2023-24 season, the NBA had a remarkable year, generating around $13 billion in league-wide revenue. This figure could see another significant increase this season, not including the national media deals the league secured over the summer. These new contracts, which will take effect next season, are projected to bring an additional $4 billion annually compared to previous agreements.

This ongoing surge in revenue is driving the value of the league’s 30 franchises upward, with an average worth of $4.4 billion, a 15% rise from last year. Forbes estimates that no team would sell for less than $3 billion, and three franchises have reached valuations of at least $7 billion: the Golden State Warriors ($8.8 billion), the New York Knicks ($7.5 billion), and the Los Angeles Lakers ($7.1 billion). Only five other teams across all sports—namely the $7.55 billion New York Yankees and four NFL teams, led by the $10.1 billion Dallas Cowboys—currently match that high valuation.

A clear indication of investors’ eagerness to invest in basketball is that every NBA team now has a revenue multiple greater than 10, with the average reaching 11.7—up from 10.9 last year and 6.9 over the past decade.

This trend follows a decade ago when Steve Ballmer purchased the Los Angeles Clippers for $2 billion, a move viewed at the time as a significant overpayment, particularly since no NBA transaction had previously exceeded a revenue multiple of 5.1. Ballmer’s deal, however, came in with a multiple above 15. Forbes was skeptical as well, valuing the Clippers at $1.6 billion in January 2015 based on $146 million in revenue, resulting in a multiple of 11; that year, no other team surpassed a multiple of 10.

Now, with the Clippers moving into their new $2 billion arena, the Intuit Dome in Inglewood, their revenue multiple has surpassed 15 once again—but this time, it’s not an anomaly. After spending 25 years at what is now Crypto.com Arena, where they were essentially the third tenant behind the Lakers and the NHL’s Kings, the Clippers are poised for a significant increase in premium seating and sponsorship revenue. This includes a reported $500 million naming rights deal over 23 years, which translates to an average of $21.7 million annually—more than $7 million higher than any other NBA team earned from arena naming rights last season, according to Forbes estimates.

Several other NBA teams are also looking to build new or significantly renovated arenas, anticipating the revenue boosts that typically accompany such projects. For example, the Toronto Raptors are undergoing a $350 million upgrade at Scotiabank Arena, while Oklahoma City has approved over $800 million for a new home for the Thunder. Recently, Washington, D.C. Mayor Muriel Bowser announced a financing agreement for the redevelopment of the Wizards’ Capital One Arena.

A striking example of the impact a new arena can have is the Golden State Warriors, who have been the NBA’s most valuable team for the third consecutive year. They generated an estimated $440 million in local revenue during their last season at Oracle Arena in Oakland (2018-19). Following their move to the Chase Center in San Francisco, the Warriors saw their local revenue soar to over $700 million last season. Their total revenue, including central league revenue while accounting for arena debt service and revenue sharing, reached $800 million in 2023-24. Only four other teams globally—the Dallas Cowboys, Real Madrid, Manchester City, and Barcelona—have achieved this level of revenue.

The growth is widespread throughout the league. The NBA recently renewed its uniform and apparel deal with Nike for a higher amount and has brought in new partners in various categories, such as Kendall-Jackson wine and Skims shapewear. The league’s financial stability is also strong; Fitch Ratings affirmed its A- ratings on the NBA’s outstanding debt this year. Additionally, the entrance of private equity and institutional investors since 2020 has opened up greater liquidity for existing team owners. Notably, the NBA is expanding even more rapidly on an international scale than it is domestically.

A Broadcast Triple-Double

### A Broadcast Triple-Double

The media agreements the NBA signed with three networks this summer are valued at more than double the average annual value of the league’s current domestic deals. Here’s a breakdown of the current and new deal averages:

– **ESPN/ABC**:

– **Current Deal AAV**: $1.4B

– **New Deal AAV**: $2.6B

– **TNT**:

– **Current Deal AAV**: $1.2B

– **New Deal AAV**: $2.5B

– **NBC/Peacock**:

– **Current Deal AAV**: $1.8B

– **New Deal AAV**: $5B

– **Amazon**:

– **Current Deal AAV**: Not listed

– **New Deal AAV**: $4B

Overall, the significant increase in deal values reflects the growing demand for NBA content and the league’s expanding market presence.

The league’s primary financial boost comes from its new media deals with ABC/ESPN, NBC/Peacock, and Amazon Prime Video, totaling an estimated $76 billion over 11 years. This equates to an average annual value of $6.9 billion, a significant increase from the $2.6 billion in current domestic deals with ESPN and Turner Sports, plus about $500 million from various international rights distributors. While many in the sports media anticipated that the NBA’s rights would double in value, the final agreements surpassed those high expectations. This national and international growth is helping to mitigate some concerns regarding local media rights, particularly following the 2023 bankruptcy of regional sports network operator Diamond Sports Group.

So, how high can NBA team values rise? The Boston Celtics may soon provide insight. Just two weeks after winning the league championship in July, the team’s ownership group announced it would seek to sell a majority stake. Lead owner Wyc Grousbeck recently shared with the Boston Globe that the process is “gearing up.”

Sports bankers suggest that while there are valid concerns—especially regarding Grousbeck’s desire to maintain control until 2028—the initial bids could start just above $5 billion. However, the Celtics’ storied legacy and global brand recognition, coupled with the rarity of control stakes in NBA teams, could drive the final price to $6 billion or more.